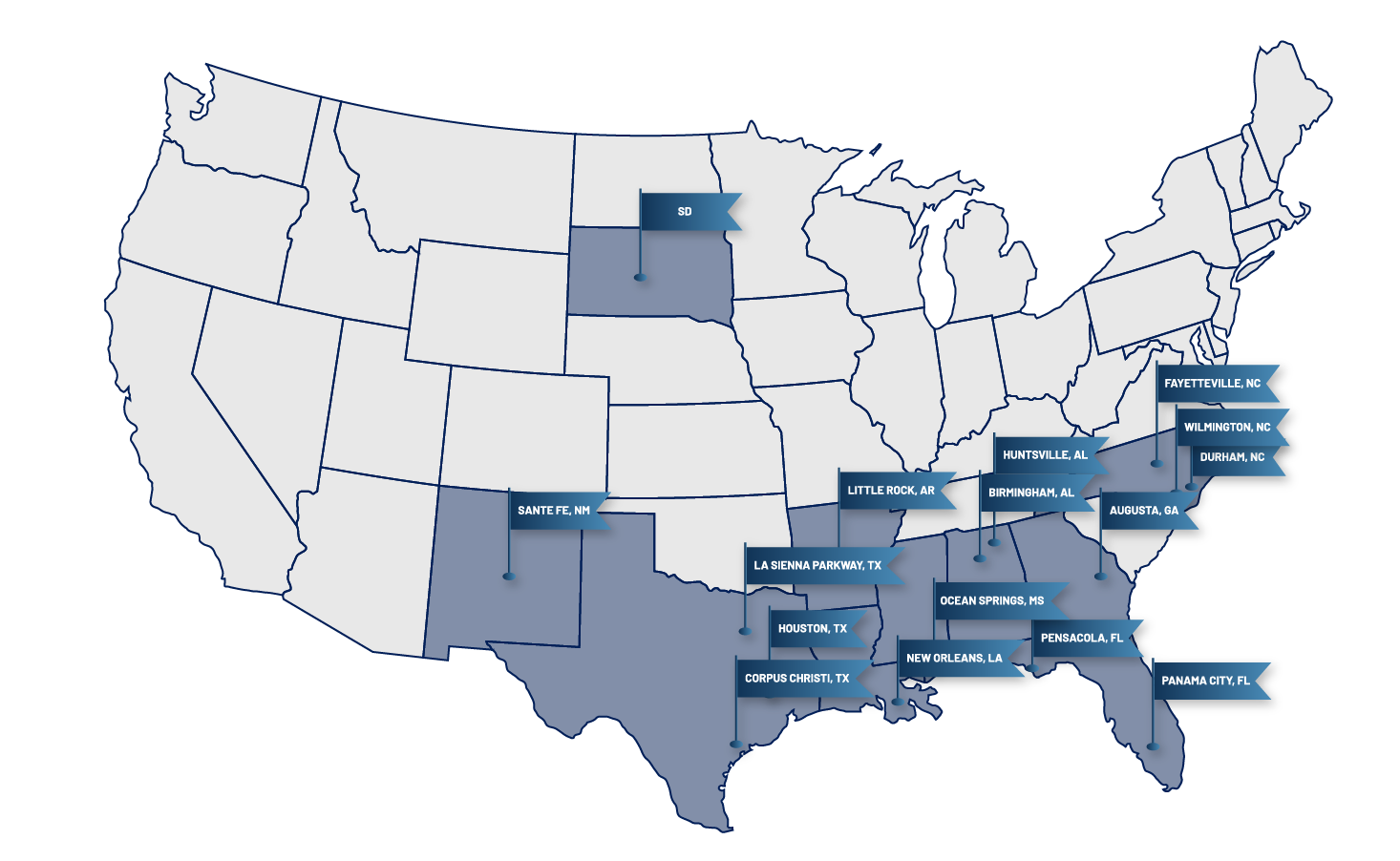

MARKETS

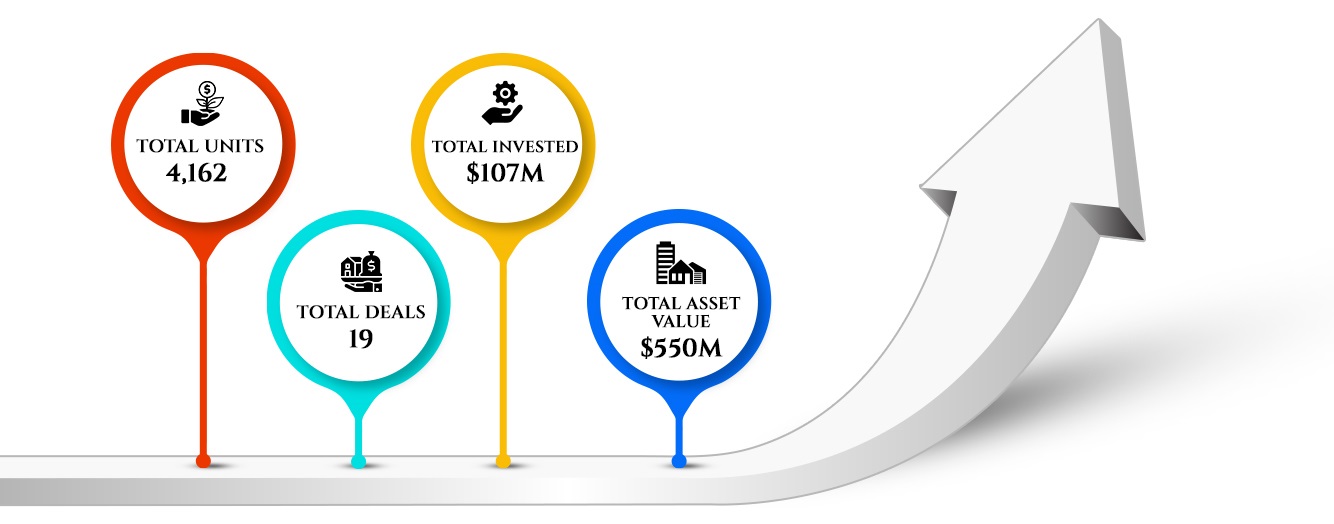

Providence Investments concentrates on markets with high barriers to entry, population growth, elevated tenant demand, key demographics, and strong employment growth. This investment strategy has generated success across multiple deals and markets.